Revenue

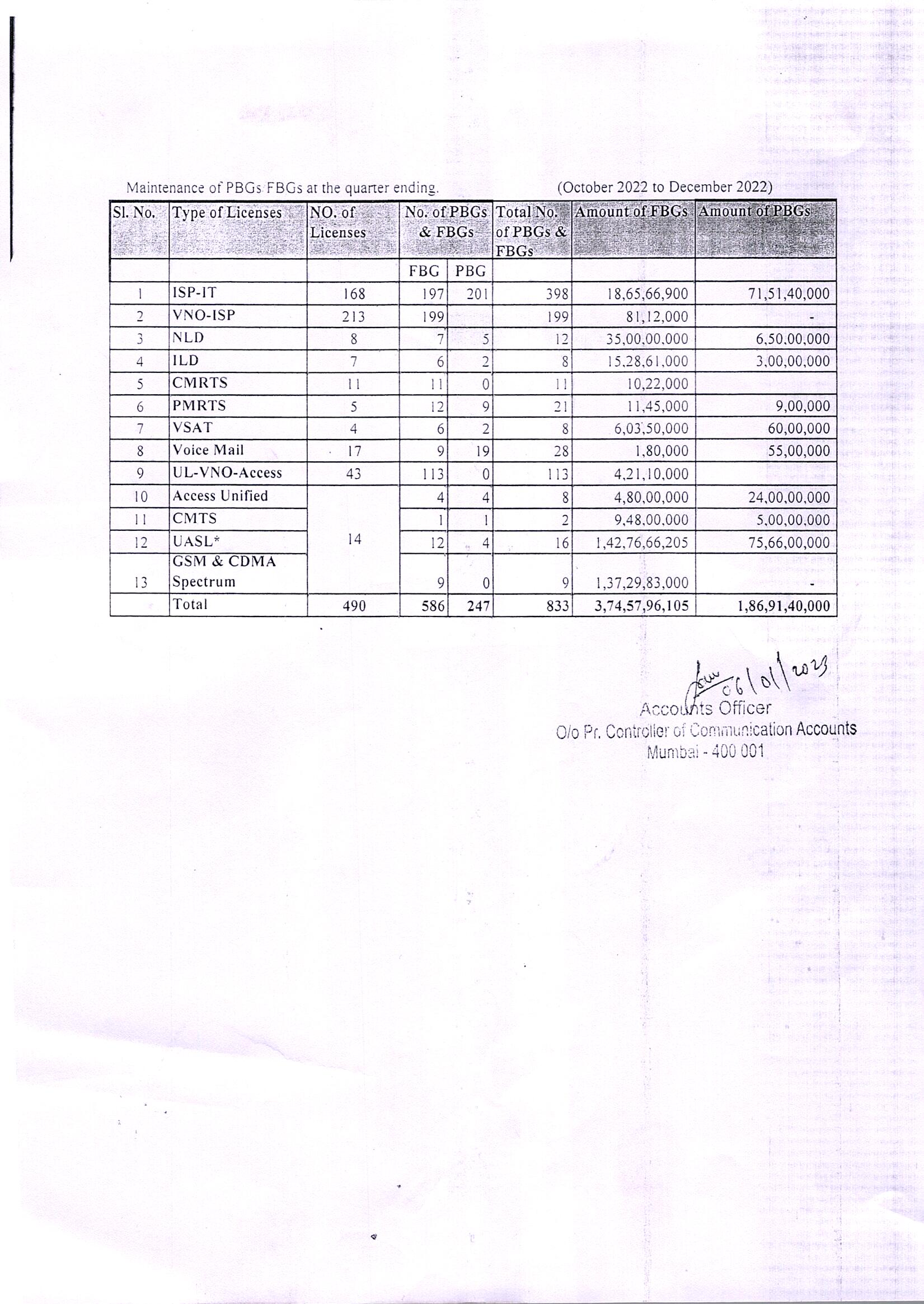

Maintenance of PBGs/FBGs for the quarter ending December, 2022.

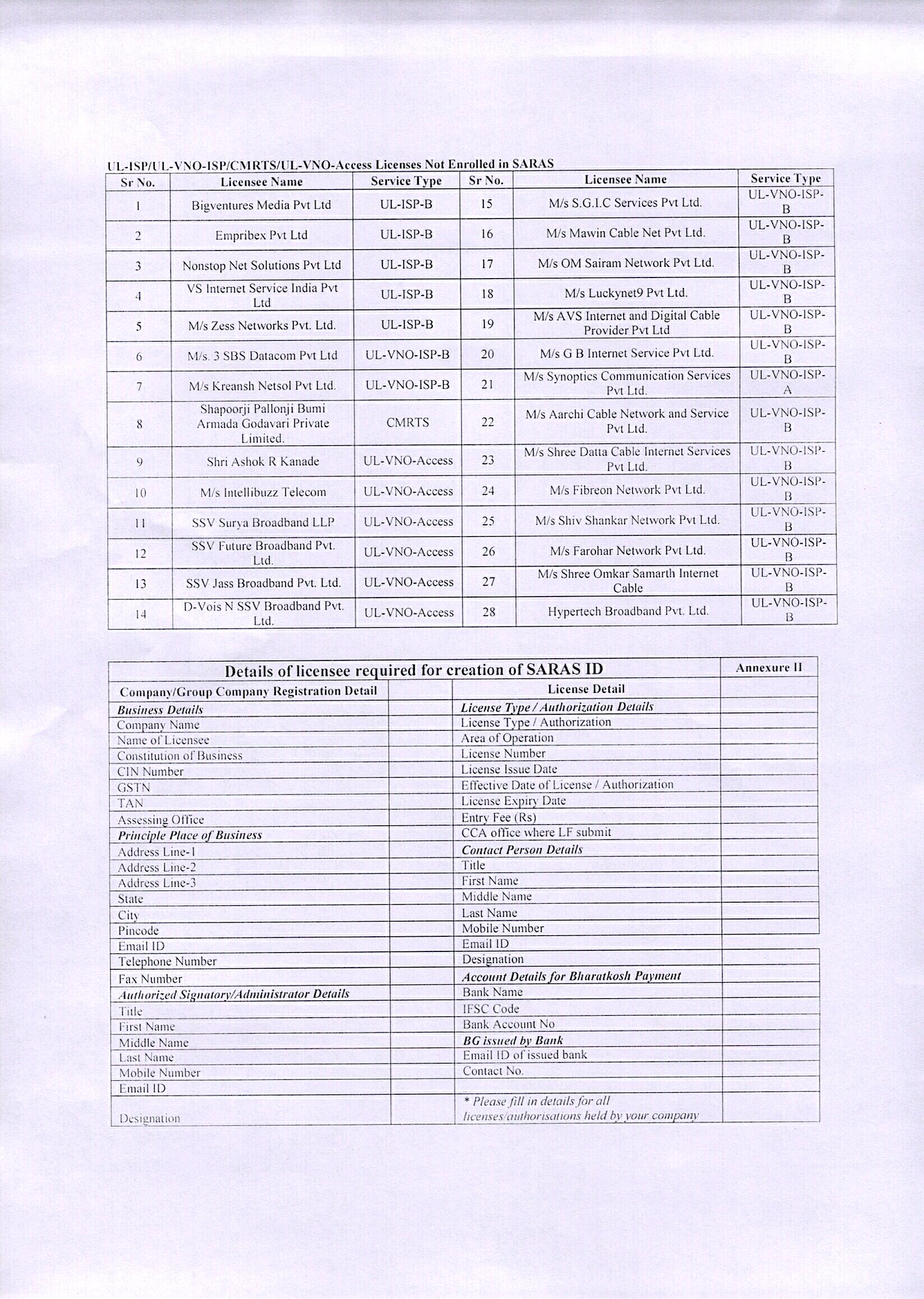

Above mentioned licensees are requested to provide data mentioned in Annexure II for their onboarding in SARAS

| SL.NO | Name Of The Licensee | Type Of License |

|---|---|---|

| 1 | Mahanagar Telephone Nigam Ltd. | CMTS |

| 2 | Vodafone India Ltd. | UASL |

| 3 | Tata Teleservices (MH) Ltd. MBI | UASL-DT |

| 4 | Reliance Communications Ltd. (MBI) | UASL-DT |

| 5 | Bharti Airtel Ltd. | UASL |

| 6 | Idea Cellular Ltd. | UASL |

| 7 | Etislat DB Telecom Pvt. Ltd. | UASL |

| 8 | Unitech Wireless (TN) Pvt.Ltd. | UASL |

| 9 | Sistema Shyam Teleservices Ltd. | UASL |

| 10 | Videocon Telecom. Ltd. | UASL |

| 11 | Aircel Ltd. | UASL |

| 12 | Reliance Jio Infocomm Ltd | Access |

| 13 | Etislat DB (MBI) | GSM |

| 14 | MTNL | CMTS |

| 15 | Reliance Jio InfocommLtd. | Unified Access |

| 16 | Bharti Airtel Ltd. | GSM |

| 17 | Idea Cellular Ltd. | GSM |

| 18 | Tata Tele services (MH) LTd | CDMA |

| 19 | Sistema Smart tele services ltd (MBI) | CDMA |

Back To CGCA

Back To CGCA

प्रधान नियंत्रक संचार लेखा

प्रधान नियंत्रक संचार लेखा